Bellow is our recent interview with Benny Silberstein, Co-Founder and Chief Strategy Officer at Payrix:

Q: Could you provide our readers with a brief introduction to Payrix?

A: Payrix was born as an embedded payments company for high-growth vertical software platforms and payment facilitators. We’re a passionate team of payments and software experts that’s created a proven solution that eliminates friction, increases revenue, and allows our customers more freedom and peace of mind to focus on growing their businesses.

Our unique, all-in-one platform — combined with our white glove approach — has enabled our clients such as Real Green Systems, Storable, and Resman to capitalize on the opportunities for growth, innovation, and transformation that embedded payments can unleash. We’re headquartered in Atlanta, GA with an office in Brisbane, Australia, and more than 100 employees worldwide. Our team is led by forward-thinkers from PayPal, Worldpay, Elavon, and Chase Paymentech, to mention a few.

Recommended: Advantages And Disadvantages Of Internal Recruitment

Recommended: Advantages And Disadvantages Of Internal Recruitment

Q: Who is your ideal client and why?

A: SaaS businesses that provide business management solutions to specific vertical markets like field services, medical/legal practices, gyms, salons, facilities, property managers, charities/nonprofits, and childcare are the biggest beneficiaries of our payments solution.

Typically our clients are B2B or B2C, range in size from 10 to 250 employees, have 250+ small to mid-sized US-based customers, and process somewhere between $10M and $2B+ in gross merchant volume. Many are already using a referral ISV/ISO solution like Stripe or CardConnect and collecting monthly or annual fees, but want to explore card-present and card-not-present capabilities. They are also looking for more control over their customer experience, while increasing revenue and decreasing onboarding time.

With a solution that scales alongside the SaaS business and requires less of an upfront lift, Payrix’s platform makes it easier for clients to transition to becoming a full payment facilitator, benefitting both our customer’s short-term and long-term payments strategy. By capitalizing on the opportunities that embedded payments provide, our customers are better-positioned to eliminate friction for their customers, while better-monetizing their platforms.

Q: Can you give us more insights into your solutions?

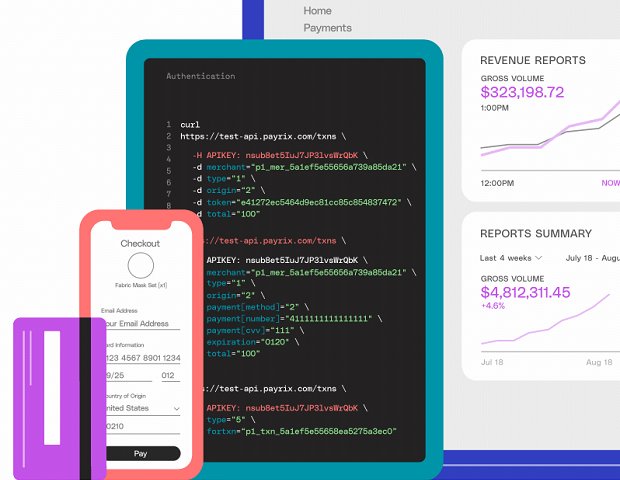

A: Whether you’re new to payments or planning to become a full payment facilitator, Payrix is the only partner you’ll need to monetize your payment experience and fuel your short- and long-term growth. Both Payrix Pro and Payrix Premium offer customers the same great platform that makes increasing revenue and strengthening their product easier, no matter where they are in their payments journey.

With Payrix Pro, customers can experience growth without the growing pains. Our fully integrated, API-first technology platform makes payment facilitation quick and manageable by offering:

o Card-present, card-not-present, mobile and e-wallet solutions

o Fast, customizable portals, customer onboarding, and underwriting

o Billing and funding solutions for you and your customers

o Easy, comprehensive portfolio management

Customers can reap the rewards of being a payment facilitator, without taking on the risk, compliance, and investment. From development to operations, our experts perform all the heavy lifting, so you can start monetizing payments faster.

Designed for registered payment facilitators, Payrix Premium delivers the same great technology as Payrix Pro, but allows for greater revenue and control.

Our clients can use Payrix Premium to harness the advantages of being a full payment facilitator, without the development lift of building out the infrastructure. The solution enables greater scalability, control, and monetization, while increasing speed to market.

Q: What can we expect from Payrix in the next 6 months? What are your plans?

A: We’re passionate about continuing to innovate our products on behalf of our clients. We’re working towards Canadian processing and e-wallets, while continuing to grow our customer base and platform volume.

Q: What is the best thing about Payrix that people might not know about?

A: Payrix is a pioneer in a quickly growing market that is fully disrupting how payment processing services are distributed. With the capability to embed payments in their core business management offering, vertical software providers can eliminate the traditional middleman of the bank or processor to generate even more revenue.

Payrix is in the right place at the right time. It’s a completely new and different space, which means educating our customers — and the market — is critical. Our platform is so unique that we’re actually seeing shifts in the competitive landscape towards our Payrix Pro model. Their solutions may be similar in design, but they’re created through a partnership — they don’t offer the same breadth, scalability and flexibility of our platform — not to mention our team’s deep expertise for managing risk and compliance, as well as servicing a payfac portfolio.

Additionally, because we’re a payment facilitator, we’re both a payments business and a technology provider, which is another important differentiating factor in the market. We know our payment infrastructure works for payment facilitators — our Payrix Premium clients — because we use it ourselves to service our Payrix Pro clients.

Finally, we want people to know that while many software verticals have been sold on this idea that they have to become a payment facilitator — and while for some that may be true, it isn’t the right solution for everyone. The right payments solution is highly dependent on their software company’s goals for CX, their aptitude for managing risk and payment operations, and their appetite for additional revenue streams.

Q: How do you explain to the average consumer the value of embedded payments?

A: We use embedded payments every time we park our car, go to the gym, pay at a restaurant, buy flowers, or order an Uber. We may not even think about the technology that happens behind the scenes because it’s so seamlessly integrated into our daily lives with card account updaters, auto billing, and mobile wallets, to mention a few. That’s really our goal — to minimize as much friction as possible, and make the payment process invisible.

For software providers, payments have historically been a utility with a lot of sacrifice made to the CX, and very little return. With payments and infrastructure providers like Payrix, software providers can now unleash greater possibilities through payments — including greater customer value, loyalty and revenue — and transform payments from a cost center to a profit center.

Adding payments also helps grow revenue per customer, and makes the SaaS product stickier. The result? Lower cost of customer acquisition, while increasing the lifetime value (LTV). We will continue to see companies like Shopify, Square and Mindbody become unicorns on the back of payments revenue for years to come.

Activate Social Media:

Recommended:

Recommended: