RealtyMogul.com is crowdfunding for real estate, they are an online marketplace for real estate investing, connecting investors who want to invest in real estate, with real estate companies that need capital to fund their projects. In order to find the right investment opportunities, they work with experienced real estate companies that need to raise equity or debt capital. Below is our interview with Jilliene Helman, CEO of RealtyMogul:

Q: You’ve recently announced $200 million in funded equity and debt transactions on your platform, how do you see the crowdfunding landscape developing, and where do you place yourself in the industry?

A: Real estate online alternative finance is still in its infancy. Between marketplace lending and crowdfunding, you’re looking at about $1.5 billion generated in the space in 2015, and while that’s a pretty significant number, it’s not a lot when compared to trillions of dollar generated in real estate annually.

So there’s definitely a lot of room for development and growth for the space and within the space. When I think about the future of the space, there are a few things that stand out:

Regulatory landscape:

The JOBS Act, which was signed into law in 2012, is what gave this space a push and made it all possible. Ever since, there have been many additional regulatory changes in the real estate crowdfunding space – further proving that the landscape is consistently developing. Most recently we saw was Title III and IV, which loosened up the reins and allowed non-accredited investors to invest in deals that used to only be available to accredited investors. This may sound like great progress, but there’s still much more that can be done.

I think that regulation will be key to the development of crowdfunding, and I hope that we can work with the SEC and FINRA to create new regulations that are more suited to how we conduct business on the internet today, but still protect investors.

Technology:

Technology is obviously key in what we do, and is a big part of our value proposition to both investors and real estate companies. As the space grows, companies that want to be successful will have to prove that they are able to leverage their infrastructure to create scale to support billions of dollars in investments. That’s not easy, but the companies that will get that right will have a significant competitive advantage. At RealtyMogul.com we see ourselves as a technology company and we put a lot of resources into making sure that our technology will give us that edge.

Economic Environment:

One of the things that was important to us as a company when we first started, was to create a balance between a technology company and an experienced real estate company. I think we’ve done a good job putting together a team of very experienced real estate professionals around our technology team. We did that, because investor protection is a core value for us, and because we’re building a company for the long term. So we reject deals and sacrifice volume today because we want to be here for the long run, and we want to be ready for whatever the market brings. It’ll be interesting to see if that’s the case for all players in the space, and how the space as a whole and the leading players in it react to a correction or a downturn when those come.

Our Position:

In terms of our position in the space:

- We lead the real estate crowdfunding space for commercial real estate in originations and funds returned to investors.

- We’re working hard to build end-to-end technology on both sides for the marketplace, and create a great user experience from origination of an investment (for a real estate company) and all the way through investor reporting. I really think that this is one of the things that could set us apart from the competition in the future.

- I believe that the technology that we’re building, our experienced credit and underwriting team, and the fact that we really try to listen to our investors and put them first, put us in a good position to strengthen our leadership position in the space going forward.

Recommended: Little Green Light Empowers Nonprofits To Fundraise More Efficiently And Effectively

Recommended: Little Green Light Empowers Nonprofits To Fundraise More Efficiently And Effectively

Q: What’s RealtyMogul’s Story?

A: We’re driven by a common goal – to make real estate investing simple.

I grew up with a dad that is an entrepreneur and a mom that is heavily involved in the luxury real estate market. I knew I’d be involved in real estate myself eventually and also knew I wanted to start my own business. On top of this, I knew whatever I did had to involve technology. I’ve spent my entire career in finance. I started managing an apartment building when I was 16, and spent most of my adult career in banking. Working for a big traditional financial institution, I noticed the heavy bureaucracy and regulatory constraints of raising and investing capital. I felt like there has to be a better way facilitating capital, and decided to create it with Justin, my co-founder and our CTO. I’ve known Justin since we were kids, and when I had the idea to start this company, he was naturally the person I thought of to start building it with me.

This company is a perfect marriage of real estate, finance, and technology – all the things I feel deeply passionate about.

Q: How does it work?

A: RealtyMogul.com is crowdfunding for real estate. We’re an online marketplace for real estate investing, connecting investors who want to invest in real estate, with real estate companies that need capital to fund their projects. Through our platform, investors can browse investment opportunities, review due diligence documents, and sign legal documents securely 24/7 online. And, in order to find the right investment opportunities, we work with experienced real estate companies that need to raise equity or debt capital. These companies submit an application online and go through our vetting process before getting approved to present opportunities.

Recommended: Afero Raises $20.3 Million Plans To Invest In Product Development

Recommended: Afero Raises $20.3 Million Plans To Invest In Product Development

Q: What makes RealtyMogul.com a good choice?

A: I think that our focus on commercial real estate transactions, our decision to offer cash-producing investments primarily, our very experienced senior management, credit, and asset management teams, and how we treat our investors, are a few of the things that set us apart from the other real estate crowdfunding platforms out there. Today, we are the first US commercial real estate crowdfunding platform to hit $200mm in fully funded debt and equity deals. A milestone we’re very proud to have accomplished.

Recommended: CONSENSUS Raises $4.2 Million To Accelerate Its Growth

Recommended: CONSENSUS Raises $4.2 Million To Accelerate Its Growth

Q: What are your plans for the second half of 2016?

A: Our core purpose is “Access Through Innovation”. So at any given moment, including the second half of 2016, we focus heavily on finding additional ways to increase access to real estate investing, whether it’s through using new technology, new regulatory developments, or anything else. Other things in our plan: continue to streamline and simplify the process for our existing investors, provide quality investment opportunities, and continue building our brand.

Q: How would you convince others to use your platform?

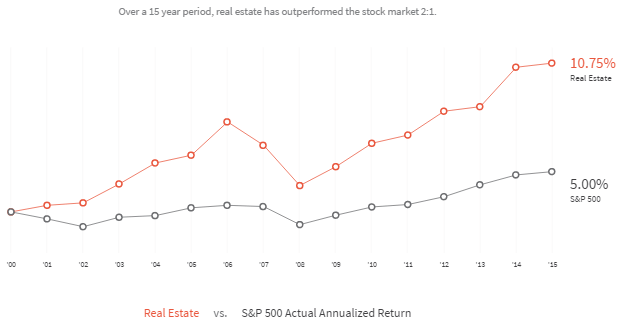

A: First, I think that real estate investing has many benefits: it can potentially generate cash flow, provide tax benefits, hedge against inflation, and be used as an effective diversification tool. Unlike stocks and bonds, you actually invest in a tangible asset, something you can touch and feel. If you believe in that, then I think that you should try our platform and be a part of bringing real estate investing into the 21st century. We’re really redefining the way people invest in real estate. We’ve built this online marketplace where you can invest in pre-vetted equity and debt opportunities 24/7 with low minimum amount, all from the comfort of your home.

And if that doesn’t convince you, then don’t forget that registration is free, so why not check us out?

Activate Social Media: