* – This article has been archived and is no longer updated by our editorial team –

Below is our recent interview with Noah Grayson, the Founder of South End Capital:

Q: Could you provide our readers with a brief introduction to South End Capital?

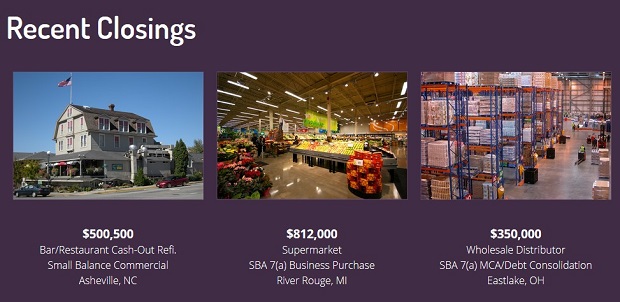

A: South End Capital Corporation “SECC” was founded in 2009 and we are a nationwide, non-conforming lender providing stated income real estate loans, subprime SBA loans, business credit lines, and merchant cash advance consolidation loans. We are dedicated to offering excellent service, prompt responses and custom tailored financing. We have also been fortunate enough to have been recognized by Fit Small Business, TopTenReviews and Business.com as one of the premier non-conforming business and real estate lenders in the country.

Q: You’ve recently announced your readiness to deploy affordable capital to business owners and real estate investors shut out by the government; could you tell us something more?

A: As a private, direct lender, South End Capital is not beholden to the government to purchase or approve the loans we make. This is why, during the government shutdown, we were still able to provide business owners and property investors affordable capital when many government dependent lenders could not. It’s encouraging that the government has temporarily re-opened, but borrowers should never have to worry that their access to capital will be impacted due to a political stalemate they have no control over.

Recommended: Local Online Marketing Is Challenging; Vivial Makes It Simple

Recommended: Local Online Marketing Is Challenging; Vivial Makes It Simple

Q: Can you give us insights into your loan programs?

A: Our focus has always been to provide non-conforming borrowers, bankable terms. Just because someone falls outside of bank guidelines, or has been dealt a hardship, doesn’t mean she shouldn’t be able to access reasonably priced capital and experience a simple loan process. Our interest rates start at 6.375%, we offer fixed loans out to 10 years and amortizations out to 30 years. We have no set credit score minimum, consider loans from $30,000 to $23,000,000 and up to 200% of the value of the borrower’s commercial or investment residential property. We also offer secured and unsecured business financing at aggressive terms via our Subprime SBA program as well as stated income, bank statement and full documentation loan programs.

Q: What collateral are you lending against?

A: We are a commercial lender, which means any property that is owned or will be purchased as an investment, or any business (with or without hard assets) will be considered for financing. South End Capital does not make primary or secondary residence loans (homes occupied by the borrower), only business purpose loans. Common financing we provide is for the purchase, refinance or unrestricted cash-out refinance of commercial or investment residential property, working capital business loans (with collateral or not), merchant cash advance consolidation loans, business purchase loans, and business credit lines.

Recommended: Synup Helps Businesses Deliver A Better Customer Experience While Managing Their Location Data And Online Reputation

Recommended: Synup Helps Businesses Deliver A Better Customer Experience While Managing Their Location Data And Online Reputation

Q: What are your plans for the future?

A: South End Capital has invested heavily in technology to make our loan process fast and easy for our borrowers and referral partners. Most of our real estate loans fund in about 30 days or less, and most of our business loans fund in about 60 days or less (the exception being our business credit line which funds in 1 day). Our goal is to continue to improve our technology to expedite our closing time and make the loan process as paperless as possible. Additionally, we recognize there are many other lenders and financial companies that are looking to provide loan options to their borrowers for whom they can’t help in-house. This year we have implemented a suite of co-branded, white-labeled, landing page and increased referral fee options for our high-volume strategic partners to help them serve more of their clients and generate more revenue. We believe the future of real estate and business lending is continued automation and synergistic strategic partnerships, and it’s our plan to be at the forefront of both.

Activate Social Media: