Below is our recent interview with Matt Michel, the Founder and Managing Partner at InvestorLink:

Q: Could you provide our readers with a brief introduction to your company?

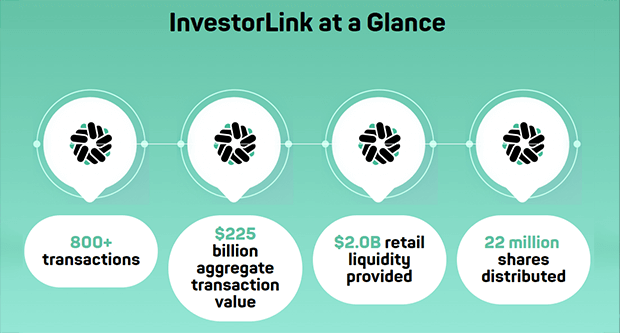

A: I founded InvestorLink after becoming fascinated with how investment banks interacted with retail liquidity within the primary markets.

What I found within the status quo was the infrastructure didn’t exist to make it easy for the two sides to interact with each other in a meaningful way at scale and that looked like a great opportunity for technology to improve outcomes for our stakeholders.

We then reinvested in our ecosystem to build a free-to-use workflow technology platform that provides investment banks with a simpler, more streamlined way to source and tailor retail liquidity for new issue offerings (IPOs, Follow-ons).

In simpler terms, when raising capital for new issue securities, it is a painful process to source retail liquidity because of the fragmented nature of the wealth management industry. Also, in contrast to institutional investors, it’s hard to judge which offerings will appeal to which retail investors, so the depth and breadth of your retail distribution matter a great deal.

Q: Can you give us more insights into your offering?

A: We provide capital markets participants with a digital workflow technology that efficiently sources retail liquidity for primary market transactions. The InvestorLink platform allows banks to spend more time on what matters and helps streamline participation of retail liquidity in new issue offerings while providing retail investors unique access to new issue markets that they otherwise would not have access to.

Q: What can we expect from your company in the next 6 months? What are your plans?

A: Overtime, we expect to expand our technology platform and refine our capabilities that we offer our investment bank partners. You can expect to see new hires and partnerships, including expanded offerings and expansion into new markets as well.

Recommended: Meet 4 Points Development – A Consulting Firm That Specializes In Real Estate Development Projects

Recommended: Meet 4 Points Development – A Consulting Firm That Specializes In Real Estate Development Projects

Q: What is the best thing about your company that people might not know about?

A: Many people underestimate how challenging the capital formation process can be. With markets becoming more volatile, having access to diverse pools of liquidity becomes increasingly important. InvestorLink is purpose-built to be the digital plumbing delivering an evergreen source of retail liquidity on-demand.

Activate Social Media:

Recommended:

Recommended: