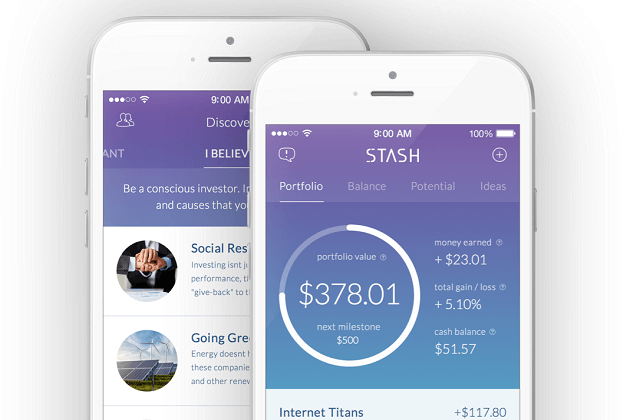

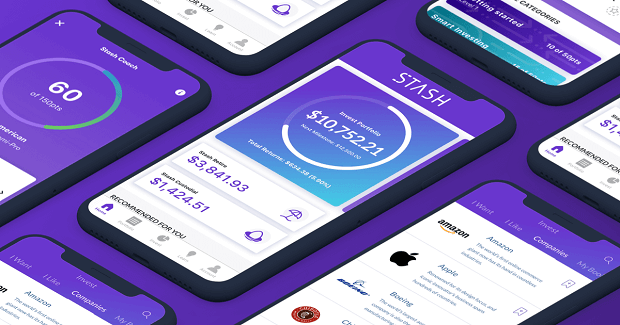

STASH is one of the fastest growing consumer investing and banking apps in the U.S., making savings affordable, accessible and attainable for millions of Americans. Through its simple, yet comprehensive platform, clients can leverage the app to reach their financial goals. With three transparent subscription plans, clients can choose the path that is right for them. Below is our recent interview with Dale Sperling, Chief Marketing Officer at Stash:

Q: What is your goal at Stash?

A: Of our 3.5M+ clients, 86% identify as first-time investors which is something we’re very proud of. Our goal is to get millions more Americans off the sidelines, start saving for their future, and building better financial habits.

Q: You’ve developed a simple, beginner-friendly investing philosophy called The Stash Way; what exactly is it?

A: With STASH, our primary mission is to make financial services easy, affordable and accessible—saving should be attainable. For investing in particular, we want to take the mystery and jargon out of it completely. We know there can be a lot of confusing terms, and it can be intimidating, even scary, to figure out the smartest way to put your money in the market or to even get started, so we’ve boiled down our investing philosophy into three basic step that we call “The Stash Way.”

Firstly, it’s so important to think long-term when investing. No one has a crystal ball or can predict what’s going to happen with the market tomorrow, or a month from now, so you want to build a portfolio with quality investments that you personally believe in, and hang onto them. Consider your time horizon—there will always be highs and lows, but in general, you’ll see that markets tend to trend upwards over time.

The second piece revolves around a core belief of ours. You don’t need a ton of money to start investing—just commit to an amount you can afford, and invest it regularly. Even small investments can add up over time. When it comes to reaching money goals, consistency is key.

And, lastly, while investing always involves some measure of risk, but spreading your money across different investments can be an effective way to reduce it. Strive for a diversified portfolio mix of stocks and funds, all across different industries. Remember: don’t put all your eggs in one basket!

Ultimately, we know that markets are always changing, they can go up one day and down the next, and that volatility can be scary. But we also know that the “Stash Way” can help smooth out some of the bumps and help you to grow savings and wealth. Through these three simple principles, clients can minimize risk and set themselves on a path to realizing their financial goals.

Q: What are the benefits of investing?

A: There are several benefits, but the first two that come to mind are: inflation protection and compound interest.

As part of our educational efforts, we talk a lot about inflation, as it’s one of the primary forces that can impact just about everything – from what you have in the bank, to what produce costs at the grocery store.

With interest rates as low as they are, keeping your cash in a savings account is akin to stuffing it in a mattress – at least as far as earnings are concerned. While it’s a good idea to keep some cash in a savings account – it’s quick and easy to access in case of emergencies, after all – it may not be the way to plan for the future. Investing on the other hand, can help shield you from inflation’s fury, and help you reach your savings goals.

You might have heard Albert Einstein’s quote about compound interest: “[it’s] the eighth wonder of the world.” Compound interest is basically interest applied to interest and it’s really at the heart of what makes long-term investing profitable. For example, if you invested $1,000 at 10% simple interest, you’d get $100 at the end of that first year. At the end of the next year, you’d get $100 more. At the end of the third year, you’d get $100 more and so on and so forth. Now, if you had 10% compounding interest, you’d receive $100 at the end of the first year, but at the end of the second year, the 10% rate would be applied to the $1,100 you now have. So, you’d receive $110. The third year, the 10% would be applied to $1,210, giving you $121 for a total of $1,331*. It’s the compound interest that lets your investments potentially flourish and grow.

Q: Retirement accounts can be one of the best ways to invest. What types of retirement accounts do you offer to your clients?

A: We offer two types of retirement accounts: Roth and Traditional. With either account, you can get valuable tax benefits. When you sign up for STASH, we’ll help you pick the account that’s right for you, then make sure to help you maximize your tax savings. Our ethos: Saving for retirement doesn’t have to be expensive and complicated.

We actually found that 40% of U.S. consumers–and nearly two thirds of millennials—say winning the lottery could be a good retirement bet. We were shocked by this. It’s more important than ever that Americans start putting money away, even if $10 a week, to build a nest egg for themselves when they retire down the road. The best thing to do is start now. By leveraging the power of compounding, investing regularly and diversifying, you can change your future.

Recommended: An Interview With CBDfx Marketing Team

Recommended: An Interview With CBDfx Marketing Team

Q: Why Stash? What makes you the best choice?

A: With STASH, clients can finally take control of their finances with one simple, transparent platform. You shouldn’t have to piece together several different (and expensive) products and services to control your finances. By merging investing and banking, STASH is an affordable and accessible financial home for all of your money needs, to help you reach your goals and build a great foundation for your future.

As mentioned earlier, we created STASH to help make investing and saving entry barriers obsolete. By lowering the minimum and reducing fees, clients come to the platform to invest, save and bank with a set price that won’t change. And, with a powerful education engine, clients can learn about money and how it is impacted by world events, in addition to how to budget for a big trip, how to talk to their kids about money, and all those important life moments.

Q: What can we expect from Stash in the future?

A: With over 3.5 million clients on the platform, we’re looking forward to helping more and more Americans build smarter financial habits for themselves and their families. With banking and investing within one platform, we’re trying to upend a system that has been systematically broken and unfair. There’s a lot more work to be done, and we’re excited for what is to come.

*Example is a hypothetical illustration of mathematical principles, and is not a prediction or projection of a performance of an investment or investment strategy.

Disclosure: Superb Crew is a paid partner of StashInvestment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. Debit Account Services provided by Green Dot Bank, Member FDIC. This material has been distributed for informational and educational purposes only, and is not intended as investment, legal, accounting, or tax advice. Investing involves risk.

Activate Social Media:

Recommended:

Recommended: